PHOTO: Hyundai Motor Philippines executives with its partners for Hyundai Finance.

Hyundai Motor Philippines Inc. (HMPH), with local bank partners, will be providing a range of car payment options exclusively under “Hyundai Finance”. The brand is establishing the said program with its first batch of local partners namely East West Bank (EWB), Banco De Oro (BDO) and Bank of the Philippine Islands (BPI). Three (3) of the country’s most trusted banks that will support fast and easy applications for Hyundai customers.

A ceremonial agreement signing on this newest undertaking took place last October 19, 2023 at CONRAD Manila in Pasay City. Together with Mr. Dongwook Lee, HMPH President, and Mr. Cecil Capacete, HMPH Managing Director, were Ms. Jocelyn Legaspi, EWB First Vice President – Secured Lending Head, Ms. Susan Audrey Rivera, BDO Senior Vice President – Consumer Lending Group Head as well as Mr. Dennis Fronda, BPI Senior Vice President – Retail Lending Bancassurance Group Head.

“Hyundai Finance is being introduced to better meet the needs and help more Filipino drive home their dream Hyundai. We wish to make the overall buying process all the more convenient for them. Which is one of the many proactive efforts we are taking to keep our promise to continuously innovate the Hyundai brand experience,” according to Mr. Dongwook Lee, President of HMPH.

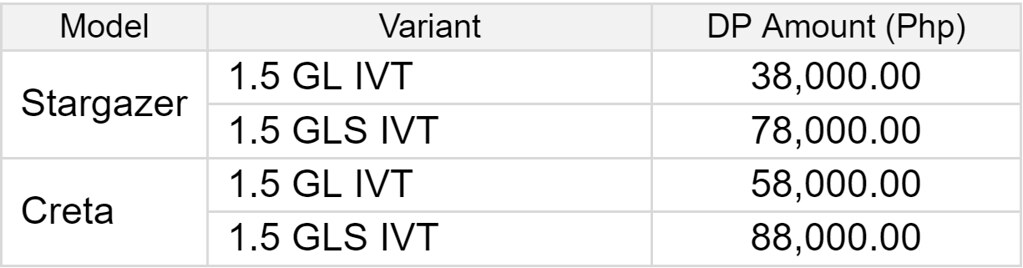

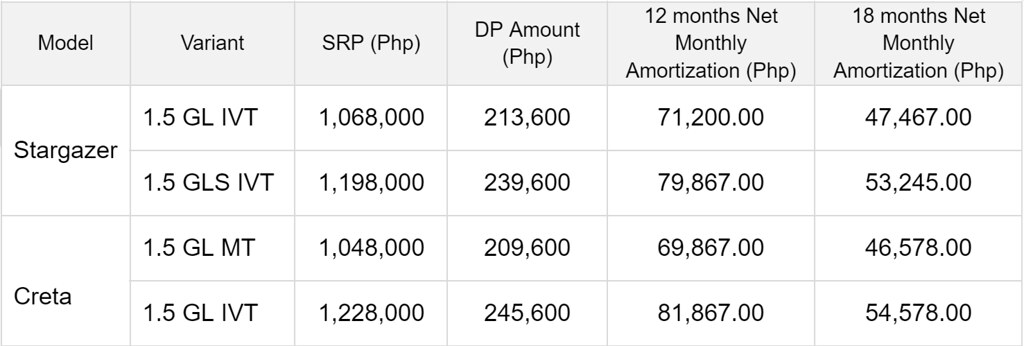

As a start, a set of financing schemes* for the Creta and Stargazer are being rolled out:

- Low cash outlay based on 20% downpayment (DP) for 60 months term

- Free Amortization of up to 5 months for 60 months term

- Zero Interest at 20% downpayment for 12 or 18 months term

For the detailed terms and conditions, visit Hyundai Motor Philippines’ website. Those interested may fill out the form online or inquire at their nearest Hyundai dealership.

*Note: Subject to bank approval, period is from November 3 to December 31, 2023.