Gross profit margin hits record high, fueled by an efficiently executed core strategy.

Xiaomi Corporation (“Xiaomi” or the “Group”; stock code:1810), a consumer electronics and smart manufacturing company with smartphones and smart hardware connected by an Internet of Things (“IoT”) platform at its core, announced its unaudited consolidated results for the three months ended September 30, 2023 (“2023 Q3” or “the Period”). Through the steadfast implementation of its core operating strategy focusing on “dual emphasis on scale and profitability” and premiumization strategy, Xiaomi has significantly boosted both its revenue and profitability. The Group achieved the first year-over-year (“YoY”) quarterly revenue growth in the past six quarters, with its quarterly profit hitting a two-year peak. In the third quarter of 2023, the group’s total revenue soared to RMB70.9 billion. Adjusted net profit reached RMB6 billion, up 182.9% YoY. The Group’s adjusted net profit for the first three quarters was 1.7 times that of last year’s total, beating market estimates.

Xiaomi Corporation’s Founder, Chairman, and CEO Lei Jun set forth a new goal for 2020- 2030 in October this year. Under its new goal, the Group is committed to sustainable investments in foundational core technologies and is dedicated to becoming a leader in the evolving realm of global cutting-edge technologies”. It underscores Xiaomi’s strong commitment to research and development (“R&D”) investment. In the third quarter of 2023, Xiaomi’s R&D expenses reached RMB5 billion, up 22.0% YoY. The R&D personnel has risen to account for more than 53% of the total workforce. The Group upgraded its strategy from “Smartphone x AIoT” to the “Human x Car x Home” and unveiled its brand new operating system Xiaomi HyperOS, integrating all consumers’ needs in one smart ecosystem from personal devices, smart home products, to smart mobility.

Xiaomi has efficiently executed its strategy of “dual emphasis on scale and profitability”. In the third quarter of 2023, the Group’s gross profit margin reached 22.7%, marking an increase for four consecutive quarters. Total inventory was RMB36.8 billion, down by 30.5% YoY, hitting its lowest level in the past eleven quarters. The reduction empowered Xiaomi to flexibly adapt its business strategy in response to the evolving industry demands. As of September 30, 2023, the group’s cash resources have continued to grow, reaching a record high of RMB127.6 billion, providing a strong foundation for Xiaomi to foster innovation.

Premium smartphones garner sales and recognition, propelling gross profit margin to a record high

In the third quarter of 2023, the global smartphone shipments slightly decreased by 1.1% YoY. Xiaomi’s smartphone shipments defied the headwinds, showing growth both YoY and quarter-over-quarter (“QoQ”). Its global smartphone shipments amounted to 41.8 million units, the highest level in the past six quarters.

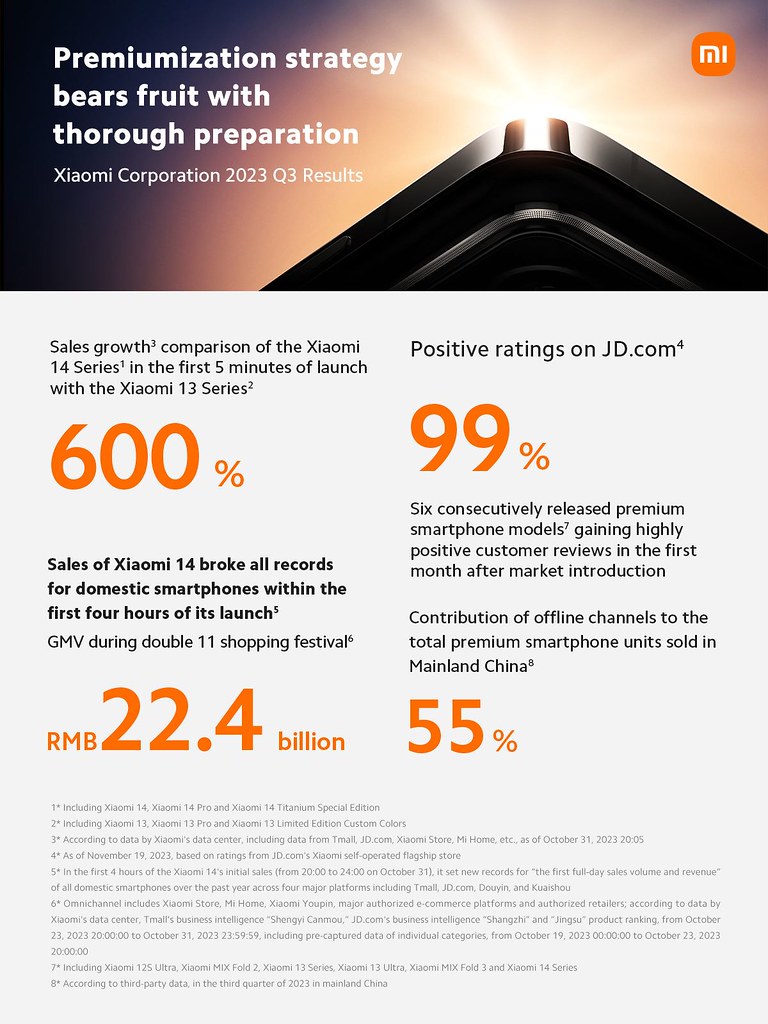

During this Period, Xiaomi’s smartphone business saw a 13.8% QoQ revenue growth, reaching RMB41.6 billion. Its gross profit margin reached a record high of 16.6%, an increase of 7.7 percentage points YoY. As an integral part of the Group’s core strategy, Xiaomi continued to forge ahead with its premiumization strategy, gaining widespread user acclaim and achieving remarkable sales. In October, the Group launched the Xiaomi 14 Series in mainland China. In the first five minutes after launching sales, sales of the Xiaomi 14 Series reached six times the initial sales volume of the Xiaomi 13 Series, exceeding one million units in the initial sales period and earning positive ratings of over 99% on JD.com. Xiaomi has released six consecutive series of premium smartphone models, including the Xiaomi 14 Series, all of which gained highly positive customer reviews in the first month after their market introductions.

According to Canalys, Xiaomi is the only brand among the top three to record a YoY increase in shipments this quarter, spearheading the resurgence in growth. With a market share of 14.1%, Xiaomi maintained its No. 3 global smartphone shipment ranking for thirteen consecutive quarters. It ranked the top three across 55 countries and regions and ranked in the top five across 65 countries and regions, reinforcing its status as a frontrunner in the industry.

Xiaomi continued to improve the efficiency of its new retail business. According to third- party data, in the third quarter of 2023, offline channels contributed over 55% of its total premium smartphone units sold in mainland China. In the latest Double 11 shopping festival, Xiaomi’s cumulative gross merchandise value (GMV) amount to over RMB22.4 billion, setting a new record high during shopping festivals.

Taking product connectivity to new heights to fuel growth momentum of the IoT and lifestyle products segment

In the third quarter of 2023, revenue from the Group’s IoT and lifestyle products was RMB20.7 billion, an increase of 8.5% YoY, and its gross profit margin reached a record high of 17.8%, up 4.3 percentage points YoY.

Xiaomi’s ecosystem products boast the advantage of interconnectivity. As of September 30, 2023, the number of connected IoT devices (excluding smartphones, tablets and laptops) on the Group’s AIoT platform reached 699 million, up 25.2% YoY; the number of users with five or more devices connected to the Group’s AIoT platform (excluding smartphones, tablets and laptops) reached 13.7 million, representing a YoY increase of 26.0%.

Xiaomi’s smart TV continues to maintain its leading positing in mainland China. According to All View Cloud (“AVC), in the third quarter of 2023, the Group’s TV shipments ranked No. 1 in mainland China. Additionally, according to Canalys, its global tablet shipments increased by more than 120% YoY, entering the top five in global tablet shipment ranking for the first time.

Pursuing excellence to strengthen internet leadership advantage

Driven by the expansion of its smart ecosystem and continuous optimization of operating efficiency, Xiaomi’s internet services revenue achieved another quarterly record high, reaching RMB7.8 billion, an increase of 9.7% YoY. The gross profit margin of its internet services reached 74.4%, an increase of 2.3 percentage points YoY. The monthly active users (“MAU”) of MIUI globally and in mainland China hit record highs. In September 2023, the global MAU of MIUI reached 623 million, an increase of 10.5% YoY, while the MAU of

MIUI in mainland China reached 152 million, up 7.4% YoY.

Xiaomi’s globalization strategy poses immense potential. During the Period, Xiaomi’s revenue from overseas internet services increased 35.8% YoY to RMB2.3 billion, hitting a record high, accounting for 30.0% of the total internet services revenue. Xiaomi’s advertising revenue in the third quarter of 2023 reached RMB5.4 billion, an increase of 15.7% YoY, setting another quarterly record. By leveraging consistent operational innovation, Xiaomi’s gaming business grew YoY for the ninth consecutive quarter.

Strategic Upgrade to “Human x Car x Home”

In the third quarter of 2023, Xiaomi’s R&D expenses were RMB5 billion, up 22.0% YoY. The group is committed to attracting and nurturing technological talent. As of September 30, 2023, the Group had 17,563 R&D personnel, accounting for more than 53% of its employees. In addition, Xiaomi continued to extend its intellectual property capabilities to foster innovation. As of September 30, 2023, it has obtained more than 35,000 patents worldwide.

In October 2023, Xiaomi unveiled its new operating system Xiaomi HyperOS, which is a human-centric operating system designed and tailored to connect personal devices, cars, and smart home products in a smart ecosystem. With Xiaomi HyperOS, its goal is to achieve Comprehensive Refactoring to optimize device performance, Cross-Device Intelligent Connectivity, Proactive Intelligence, End-to-End Security and Open Platform. The core of Xiaomi HyperOS is formed by Xiaomi’s self-developed Xiaomi Vela system with a deep customization of the Linux system. The Group restructured fundamental modules, such as performance scheduling, task management, memory management, and file management, resulting in a substantial boost in performance and efficiency. For Cross- Device Intelligent Connectivity, Xiaomi HyperConnect, its proprietary advanced Cross- Device Intelligent Connectivity framework, facilitates highly efficient connections between multiple devices and enacts ultimate collaboration. The Group’s commitment to Proactive Intelligence has given rise to Xiaomi HyperMind, its cross-device smart cognitive center. Xiaomi HyperOS takes a step further by supporting advanced AI technologies and enabling devices to provide a host of AI-driven features. For End-to-End Security, its self- developed trusted execution environment (TEE), operated on dedicated hardware, serves as the foundation of its security subsystem. Xiaomi employs end-to-end encryption through TEE for data transmission between devices, extending its protective umbrella to interconnected security modules. Furthermore, Xiaomi HyperOS adheres to the principle of an open platform. The Group has extended open invitations to developers of applications and smart hardware and grant them open access to Xiaomi HyperConnect, and it has also announced the open-sourcing of Xiaomi Vela, empowering developers globally for greater innovation and collaboration.